A common gap in any Customer 360 initiative is data related to billings and payments. The workaround? Reps in sales, support and success either engage customers with incomplete information or they waste precious time playing “telephone tag” with contacts in the Finance department to get a full view. And any quote to cash automations stall out when this information isn’t accessible in near-real-time.

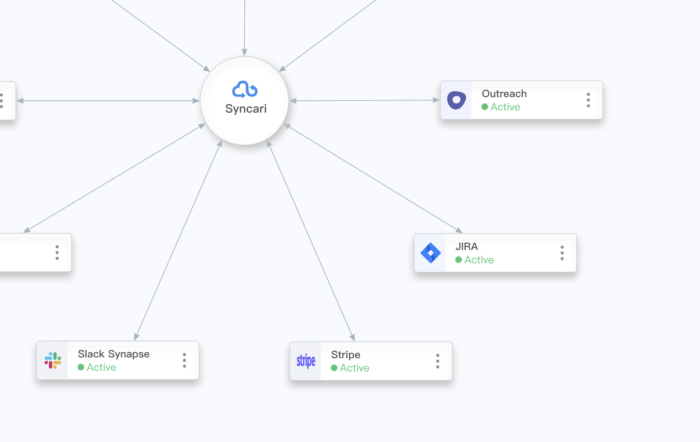

Syncari uses Synapses to align revenue data and statefully sync records across your tech stack whenever changes occur. See all the data sources we keep in sync in the Synapse Library.

Syncari uses Synapses to align revenue data and statefully sync records across your tech stack whenever changes occur. See all the data sources we keep in sync in the Synapse Library.

How to align, augment and activate data from Stripe

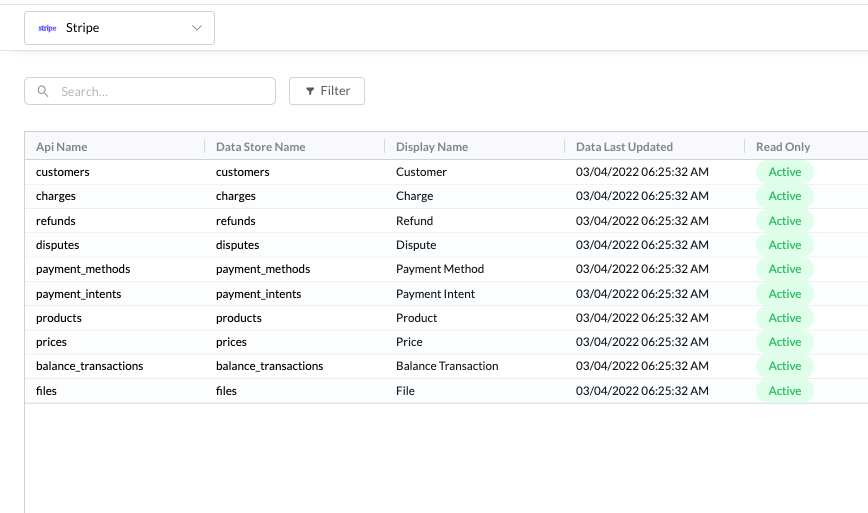

With the new Stripe Synapse, these gaps disappear. Syncari aligns data from Stripe with data from any other system in your tech stack. With this data in place, you can take actions like creating a customer or distributing data like existing charges, products and prices with key stakeholders in the systems where they work – like your CRM.

Connecting Stripe with Syncari also makes it easy for you to run custom calculations for MRR and ARR. Another way to use data in Stripe is to set payment intents to accept a payment or account and read charge details to anticipate which accounts need customer success intervention because of a failed card.

The Stripe Synapse aligns payments detail with the rest of your customer data to create a complete, accurate view.

The Stripe Synapse aligns payments detail with the rest of your customer data to create a complete, accurate view.

Why Syncari?

Making Stripe work with the rest of your revenue tech stack isn’t easy. Talk to us if you’d like to uplevel the experience of dealing with data in Stripe and create an aligned view of your data across systems that benefits multiple teams in your organization. With Syncari, you’ll be building a distributed source of truth that makes connecting systems a repeatable process, not an unknown journey.